Circulation no.14S/1943 of the General Commission of Taxes issued on 19th Oct 2023

The General Secretariat of the Council of Ministers, in accordance with Circular No. 44651 issued on 18/9/2023, and Council of Ministers Resolution No. 23572 of 2023, has outlined a process for reforming the tax system summarized as follows:

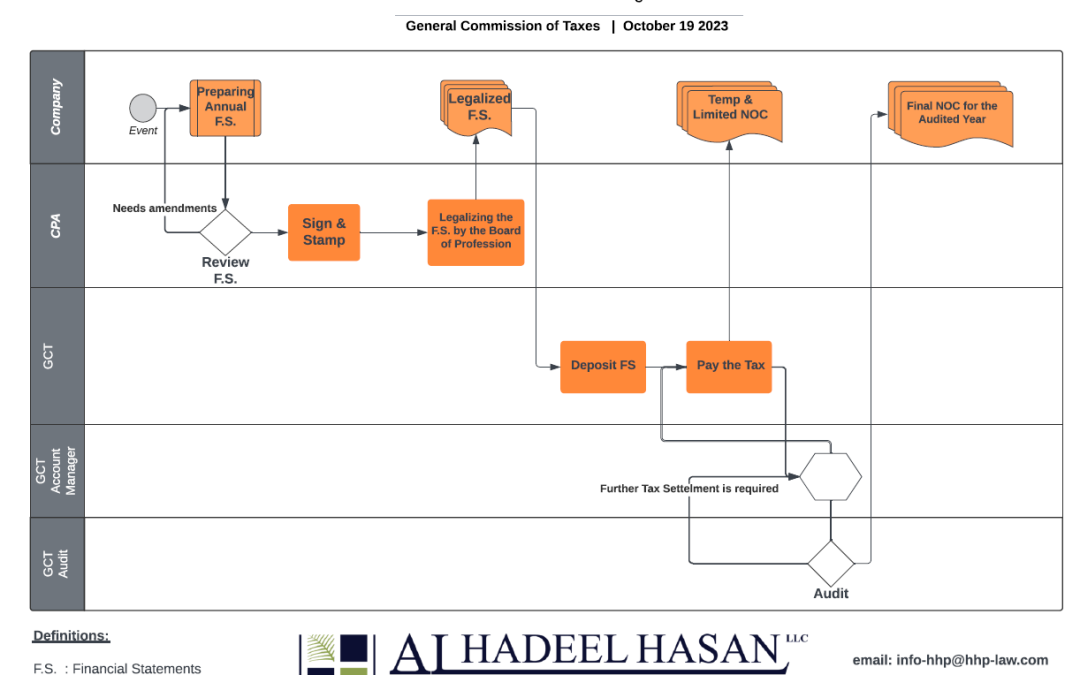

- Taxpayers must submit annual financial statements certified by licensed auditors to the General Commission of Taxes (GCT), and the tax calculations are based on these statements, leading to the collection and issuance of the necessary documents for business activities such as non-objection letters to entering tenders and auctions, letters of payment of dues, and letters of facilitation of movement. Etc… Taking into consideration that the estimated tax amount shall be subject to future review.

- The GCT collaborates with the Federal Board of Supreme Audit and the Iraqi Association of Chartered Accountants to audit financial statements, apply deterrent measures against tax evasion, and hold taxpayers responsible for any legal consequences that may result accordingly.

- Clearance letters are granted to the taxpayers based on tax calculation (the said letters shall be effective for the legal period stipulated in Article (27) of the amended Income Tax Law No. (113) of 1982), and any contract’s tax calculation completed after the submission of the annual financial statements shall be subject to tax collection.

- Undisclosed income is treated as a violation of Income Tax law, and accordingly, taxable profit is calculated in light of the effective circulations of the GCT.

Download the Circular 14s/1943 اعمام الهيئة العامة للضرائب

Download the Flowchart GCT Flowchart 19-10-2023 – circular 14s-1943

Recent Comments